Glass House reported preliminary financial results for the fourth quarter and year ended December 31, 2023.

Net revenues for 2023 were $160.8 million, an increase of 89% from 2022, primarily driven by increased wholesale biomass production and sales from the company's SoCal Farm.

Wholesale biomass revenue was $105.7 million, increasing 155% versus 2022.The Company sold 339,000 pounds of wholesale biomass in 2023 versus 172,400 pounds in 2022, a 97% increase. We also benefited from a higher average selling price of $312 per pound during 2023, up 43% vs. 2022.

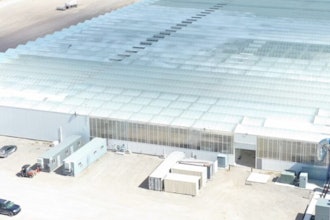

Podcast: Graham Farrar: Building the Largest Cannabis Farm in California

Retail revenue reached $39.1 million and increased by 46% versus 2022, driven by incremental revenues from the four retail locations we acquired in Q3 2022, a fifth retail location acquired in April 2023 and two new Farmacy stores opened around year-end 2022.

Wholesale CPG revenues were $16.1 million, compared to $16.8 million in 2022.

Fourth quarter highlights:

- Net sales of $40.4 million, an increase of 35% from $29.9 million in Q4 2022 and down 16% sequentially from $48.2 million in Q3 2023;

- Gross profit was $18.0 million, compared to $9.2 million in Q4 2022 and $26.0 million in Q3 2023;

- Gross margin was 45%, compared to 31% in Q4 2022 and 54% in Q3 2023;

- Adjusted EBITDA was $3.8 million, our fourth consecutive quarter of positive EBITDA, compared to $(3.4) million in Q4 2022 and $10.7 million in Q3 2023.

- Fiscal year 2023 Adjusted EBITDA reached $24.5 million, compared to $(22.3) million in the same period last year.

- Operating cash flow was $1.4 million, compared to negative $9.3 million in Q4 2022 and $9.1 million in Q3 2023.

- Fiscal year 2023 operating cash flow reached $23.2 million, compared to $(40.8) million in the same period last year.

- Cost per equivalent dry pound of production was $121 a decrease of 5% compared to the same period last year and up 2% sequentially versus Q3 2023;

- Equivalent dry pound production was 103,500 pounds, up 37% year-over-year;

- Cash balance was $32.5 million at year-end, up 130% versus $14.1 million at the end of last year.

"2023 was a year of remarkable growth for Glass House Brands, during which revenue increased by 89% to a record $160.8 million while Adjusted EBITDA reached $24.5 million and operating cash flow was $23.2 million. Glass House has delivered rapid, sustainable growth since its inception. Our 2023 revenue is over 2.5x higher than 2021, the year in which we listed, and 2023 gross profit dollars are more than 5x higher than 2021," said Kyle Kazan, Co-Founder, Chairman and CEO of Glass House. "We wrapped up 2023 with a fourth quarter in which we produced 103,500 pounds of biomass. This was above the high end of guidance of 100,000 to 102,000 pounds and also 37% higher than the same quarter last year with no expansion in cultivation footprint. Strong demand for everything we grow continues and we ended the year with finished goods inventory relative to sales of less than two weeks. We need more inventory to meet this demand and are very excited that Greenhouse 5 is now online and fully planted after starting cultivation at the end of January."